Casinos Accepting Postepay

Are you after top rated casino sites accepting Postepay? If yes, below you can find our expert selection of the best online casinos that accept deposits and withdrawals with Postepay.

Using Postepay is just as safe and simple as transacting with your Visa, Visa Electron, or Mastercard. Players can purchase their Postepay cards at thousands of post offices across the country and reload depleted cards either online or in person at those post-office locations.

| Summary | |

|---|---|

| Country used in | Italy |

| Website | postepay.poste.it |

| Accepted by | Over 30 Online Casinos |

| Casino Games with Postepay | Slots, Roulette, Blackjack, Video Poker |

| Available for deposit | Yes |

| Available for withdrawal | Yes, if Visa or Mastercard are accepted |

| Purchase Postepay card | 10 – 70 EUR |

| ATM withdrawals | 1-5 EUR (+1.1% of the withdrawal amount) |

| Make a payment via Postepay card | FREE |

| Make a non-EUR payment via Postepay | 1.1% of the payment amount |

| Transfer funds from Merchant to Postepay card | FREE (small fees may apply) |

| Online Chat | Yes |

| servizio.clienti@posteitaliane.it | |

| Telephone | Italy: 803-160 | Italy Toll Free: 800-003-322 |

Having a local tax identification number is required for Italian gamblers who wish to use Postepay. This article provides extensive information on depositing and withdrawing with Postepay, alongside a listing of the top online casinos supporting this prepaid method.

Pros and Cons of Postepay Casinos

- Pros

- Does not require opening a bank account

- Dedicated Postepay apps for Android and iOS devices

- Works for both deposits and withdrawals

- No additional fees on the casinos’ side

- Cons

- Suitable for Italian players only

- Transactions are processed only in euros

- Requires an Italian tax identification number

Top Rated Postepay Casinos

-

Trustpilot Score

1.4

Licenses • The Alcohol and Gaming Commission of Ontario (AGCO)

• The Danish Gambling Authority (DGA)

• The Government of Gibraltar (112 and 113)

• The Malta Gaming Authority (MGA/CRP/543/2018)

• The Spain Directorate General for Regulation of Gambling (DGOJ)

• The Swedish Gambling Authority (SGA)

• The UK Gambling Commission (39028)Supported languages English, Spanish, German, French, Portuguese, Swedish, Finnish, Italian, Romanian, Danish Customer support channels - Phone

- Live chat

With years of experience on the online gaming scene, 888 is now a brand name gambling enthusiasts from various jurisdictions are already familiar with. The online casino is friendly to players from Italy as the operator has obtained a seal of approval from the Italian Customs and Monopolies Agency.

- Pros

- Vast library of slots, table games and exclusive titles

- Broad range of secure methods like PayPal and Neteller

- Digital wallet withdrawals processed within 48 hours

- Licensed by ADM and several other regulators

- Frequent welcome and ongoing promotions

- Cons

- Game availability differs by location

- Verification checks may delay withdrawals

- No native app in some regions

-

Trustpilot Score

2.2

Licenses Malta Gaming Authority (MGA/CRP/258/2014)

UK Gambling Commission (039380-R-319311-032)

Danish Gambling Authority (DGA)

Swedish Gambling Authority (SGA)

Spain's Directorate General for the Regulation of Gambling (DGOJ)

Alcohol and Gaming Commission of Ontario (AGCO)

Supported languages English, Italian, Dutch,Spanish, Swedish, Danish, German, Finnish Customer support channels Live chat, email, and phone Videoslots is a trustworthy and long-established interactive casino that has grown to prominence in next to no time, thanks to its premium slots selection. The online casino caters to a slew of markets, and to introduce its services in so many parts of the globe, the operator has obtained seals of approval from multiple licensing authorities, the Italian Customs and Monopolies Agency included.

- Pros

- Extensive slots catalog from top providers

- Includes live, table and jackpot games

- Supports multiple currencies including EUR and USD

- Large list of payment methods such as Trustly and Skrill

- 24/7 support via chat, phone and email

- Cons

- Some banking options are region specific

- Verification checks may delay withdrawals

- Pros

-

Trustpilot Score

3.2

Licenses UK Gambling Commission (039198-R-319450-027)

Malta Gaming Authority (MGA/CRP/237/2013)

Swedish Gambling Authority (18Li7545)

Alcohol and Gaming Commission of Ontario (OPIG1233813)

Danish Gambling Authority (DGA)

Netherlands Gaming Authority (1970)

Spanish Directorate General for the Regulation of Gambling (DGOJ)

Irish Revenue Commissioners (1012453)Supported languages English, Swedish, Italian, Spanish,Portuguese, Danish Customer support channels - Email - support@leovegas.com

- Live chat

Launched more than a decade ago, LeoVegas is a reputable and well-established interactive casino where players from various countries are more than welcome. Operating under seals of approval from several authorities, the Italian Customs and Monopolies Agency included, there is a good reason why LeoVegas is such a well-trusted brand.

- Pros

- Wide variety of slots, table, live and jackpot games

- Dedicated iOS and Android apps plus browser play

- Fast payments with options like Apple Pay and Neteller

- Demo mode available for many titles

- Generous welcome bonus and loyalty program

- Cons

- Game availability differs by location

- Verification checks may delay withdrawals

- Payment options vary by region

-

SNAI

Trustpilot Score

1.2

Licenses Agenzia delle Dogane e dei Monopoli (16032)

Supported languages Italian Customer support channels Email and live chat SNAI is a multi-product platform that is bound to grab the attention of players, no matter whether they are taken with lotteries, sports betting, poker, or casino games. While being at the casino section of the platform, players will be offered a superb wagering experience through a broad diversity of games, including slots, live games, jackpot games, video poker, roulette, and blackjack, among others.

- Pros

- Multi product platform covering sports, poker and casino

- Advanced search and filters for easy navigation

- Mobile apps for iOS and Android devices

- Local payment solutions including Postepay and PayPal

- Attractive welcome and ongoing bonus offers

- Cons

- Available primarily to Italian residents

- Limited language support

- No phone support channel

- Pros

-

StarCasino

Trustpilot Score

1.5

Licenses Agenzia delle Dogane e dei Monopoli (15230)

Customer support channels Live chat, email, and phone StarCasino is an Italy-oriented interactive casino that started operating in 2012. With a slew of accolades to its name, StarCasino guarantees its users that their deposits and cashouts will be smooth, fast, and safe. To keep one’s promise, the operator facilitates top-ins and withdrawals via Postepay, MuchBetter, PayPal, Visa, Neteller, Mastercard, SafeCharge, and Skrill, among others.

- Pros

- More than 180 jackpot titles plus vast game variety

- Fast withdrawals within 24 hours on most methods

- Instant fee free deposits

- iOS and Android apps for mobile play

- Tables with varied betting limits for all budgets

- Cons

- Mainly targets the Italian market

- Limited language options

- Verification checks may delay withdrawals

- Pros

-

Trustpilot Score

3.9

Licenses N/A

Customer support channels - Live chat

- Email - assistance@casino.com

- Phone - +356 27782260

Casino.com is an award-winning online casino that welcomed its first users on board in 2007. The web-based casino is accessible in a broad range of countries, and Italy is not an exception. At Casino.com, players will find all games they might have a liking for as slots, live games, classics, and video poker are all on offer. These all come from the portfolio of Playtech, which is one of the most established creators of gaming content.

- Pros

- Playtech powered portfolio of slots, live and table games

- Dedicated apps for iOS and Android

- Range of secure payments including ecoPayz and Paysafecard

- Generous welcome and ongoing promotions

- 24/7 customer support via chat, email and phone

- Cons

- Game selection limited to one software provider

- No cryptocurrency payment options

-

Trustpilot Score

4

Licenses • Agenzia delle Dogane e dei Monopoli (15015)

• The Malta Gaming Authority (MGA/B2C/126/2006)

• UK Gambling Commission (39170)Customer support channels - Live chat

- Phone - (+39) 0694803332

- Email - info@netbet.it

NetBet is an online casino that is approved by the Italian Customs and Monopolies Agency, as well as by the MGA and UKGC. One of its biggest strengths is undoubtedly its game suite, as here, avid casino fans will find video poker, jackpot games, slots, roulette, blackjack, and live games.

- Pros

- Game catalog from more than 20 top providers

- Licensed by ADM, MGA and UKGC

- Wide choice of payment methods including PayPal

- Attractive welcome bonus and recurring promotions

- Responsive support via chat, phone and email

- Cons

- Some payment options are region specific

- Verification checks may delay withdrawals

- No native app in some regions

How Postepay Works

Postepay is a Visa/Mastercard prepaid card service provided by the Italian Poste Italiane. Unlike most other prepaid cards, it does not require a bank or checking account because cards are issued and serviced directly by the post office.

Postepay is a Visa/Mastercard prepaid card service provided by the Italian Poste Italiane. Unlike most other prepaid cards, it does not require a bank or checking account because cards are issued and serviced directly by the post office.

There are several types of Postepay cards, both digital and plastic, and all of them can be loaded with funds, when necessary, at the nearest post office or ATM. Other ways to recharge your Postepay card include SISAL kiosks or PosteMobile SIM cards, which are synced with your Postepay account.

Postepay cards can be used at hundreds of land-based and online merchant stores and POS terminals in Italy and abroad. They are accepted almost anywhere Visa and Visa Electron are accepted, even if no Postepay sign is specifically displayed. In many cases, Postepay digital cards also work on websites and online casinos where Mastercard is accepted.

One of the biggest benefits for Italian users who choose to make payments through Postepay is that the cards can also be used for cash withdrawals from ATMs.

Applying for Postepay

Signing up for the Postepay prepaid card service does not require linking it to a bank account. To apply, you must provide your ID and Italian tax identification number at a post office or online on the official Postepay website.

You can purchase one of the plastic Postepay cards for €5 and then activate it on the website. Issuing digital cards is free of charge, and each user can own up to three Postepay cards.

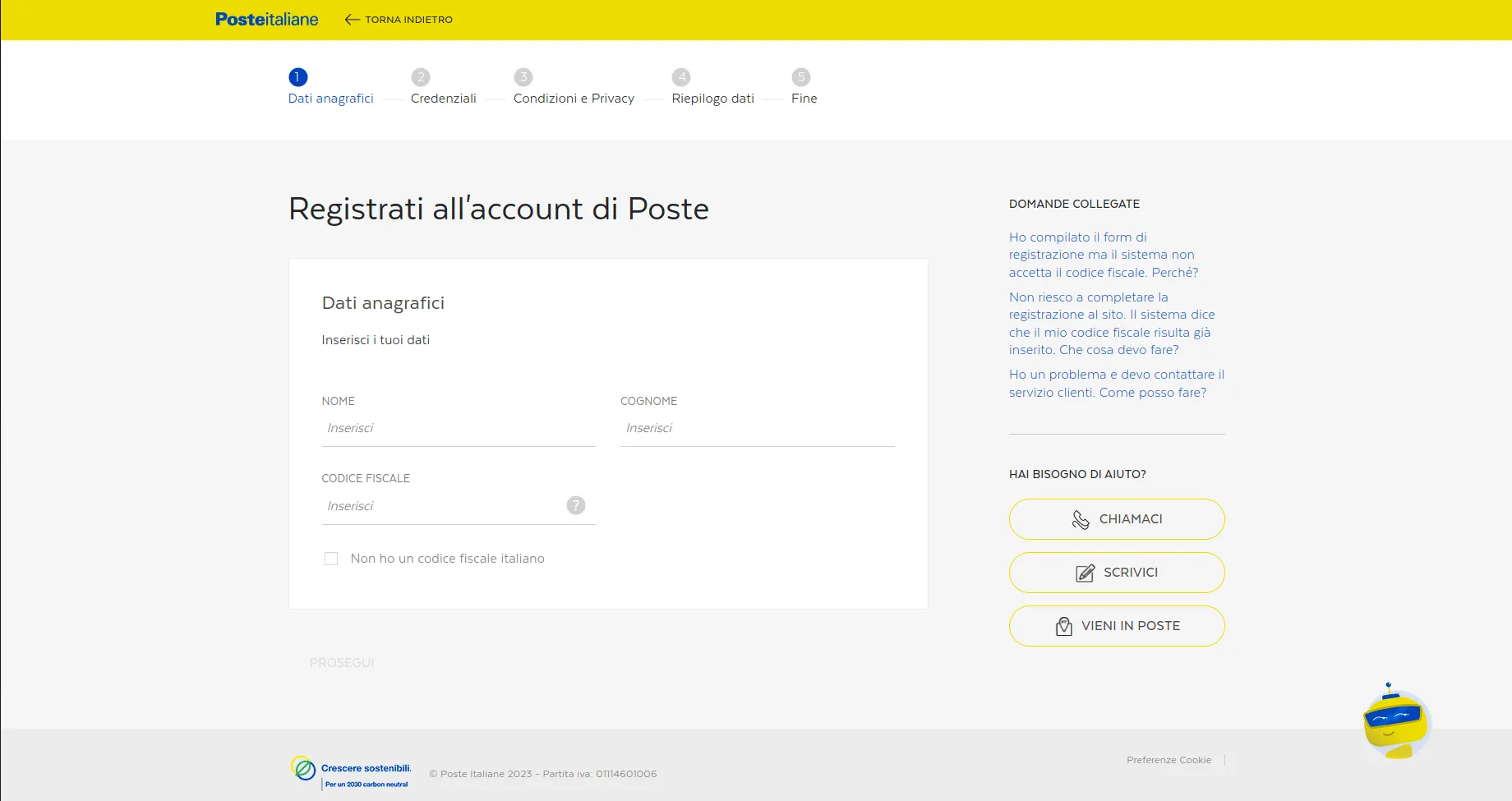

Postepay Registration Process

Offering quick processing times and increased security levels, it is not surprising that Postepay is a preferred payment method for more and more gambling enthusiasts. After its introduction in 2003, Postepay quickly became a payment method of choice for a great number of gambling fans because of its wide availability.

To make full use of Postepay, including the Postepay app, players should first register for a Poste Italiane account. The registration process is quick and straightforward, and even if players experience difficulties, they can always rely on customer support.

- If players believe that Postepay ticks all the right boxes for them, they should head to its official website and create a private Postepay account.

-

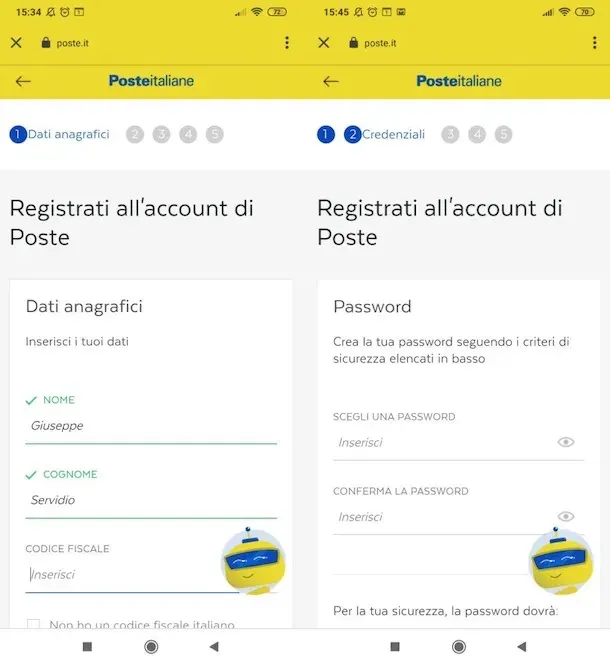

Players will then be required to provide their personal data, including first and last name and tax ID code. Gambling enthusiasts should know that if they are of legal age but live abroad and do not have a tax code, they can still use Postepay by clicking on I don’t have an Italian tax code. In this case, however, players will not receive full access to all Postepay services. After this, casino enthusiasts must also provide a valid email address.

-

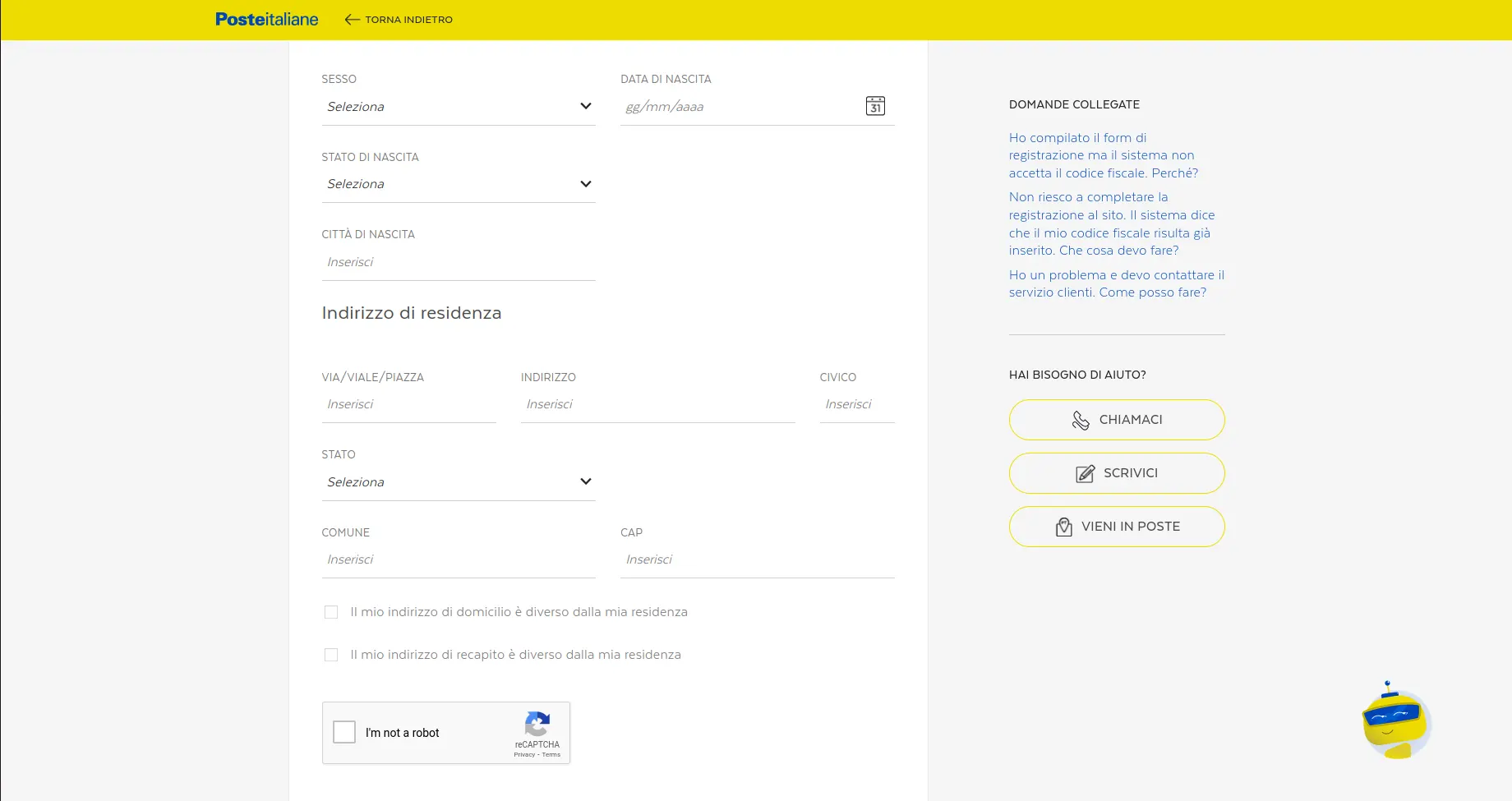

After filling in the above-mentioned information, players will be asked to select their gender, city, and state of birth and to enter their date of birth. To proceed with the registration process, players will be prompted to provide their address. Then, they need to click on the Confirm button.

- Next, players will need to create their login details. They will also be asked to provide the confirmation code that was sent to the email address they provided.

-

Finally, players must review all the information they have entered to ensure everything is correct. Then, they should click on the Confirm Registration button to complete the process. When players click on Go to MyPostepay, they will be taken to the login screen and asked to use their credentials to access their account.

Video Introduction of Postepay

Recharging Postepay Cards

Loading Postepay plastic or digital cards with funds is very easy and can be done at any of the 14,000 post-office locations across Italy or at roughly 4,500 ATMs. You can choose from cash payments, transfers from another Postepay card, using Maestro Postamat Bancoposta, or simply paying via Visa, Visa Electron, Maestro, or Mastercard.

There are many other ways to recharge your Postepay card, including at SISAL kiosks, partner tobacco shops, or even by paying cash to your local postman. You can also reload it using the Postepay or Postemobile applications, available for free download for iPhones and Android devices. PosteMobile SIM cards are also synced with your Postepay account, so they can be used for recharging as well.

Types of Postepay Cards

There are a few options to choose from when picking a Postepay card. As already mentioned, you can have three Postepay cards, so here are our top three recommendations:

Standard Postepay Visa/Visa Electron Card

This is the standard and most widely used Postepay card, which allows customers to hold up to €3,000. This option is convenient for shopping in brick-and-mortar stores and making payments online.

This is the standard and most widely used Postepay card, which allows customers to hold up to €3,000. This option is convenient for shopping in brick-and-mortar stores and making payments online.

Purchasing the plastic Standard Postepay Visa Electron Card costs €5. In addition, there are no processing or annual fees. The minimum reload is €5, while the maximum limit for recharging is €500 per transaction and €1,000 per day. Annually, users can load up to €50,000 across all cards registered under their name. The maximum daily withdrawal from an ATM is €250, while users can enjoy unlimited monthly withdrawals.

Twin Postepay Visa/Visa Electron Card

With this option, Postepay offers its customers two cards – one remains with the account holder, while the second can be given to another person as a gift, for instance. The cost is €8 and each card can hold up to €999.

With this option, Postepay offers its customers two cards – one remains with the account holder, while the second can be given to another person as a gift, for instance. The cost is €8 and each card can hold up to €999.

Users of the Twin Postepay can recharge their cards with sums ranging from €1 to €250 per transaction, or up to €250 each day. The annual maximum limit for reloading is €2,500. The maximum daily and monthly withdrawals are limited to €500 and €1,000, respectively.

e-Postepay Mastercard

This is a virtual Postepay card, ideal for use online, including in web-based stores and casinos where Mastercard is accepted. The e-Postepay Mastercard can be acquired through online registration at the official site and is free of charge. It can be loaded with up to €999, with a minimum recharge limit of €1.

This is a virtual Postepay card, ideal for use online, including in web-based stores and casinos where Mastercard is accepted. The e-Postepay Mastercard can be acquired through online registration at the official site and is free of charge. It can be loaded with up to €999, with a minimum recharge limit of €1.

The maximum daily limit for recharging this card is €500, or €250 per transaction. Annually, users can load the virtual card with up to €2,500.

Aside from these three, there are several other Postepay cards. Postepay Evolution and Postepay Evolution Business are both plastic Mastercard products. The first has an issuance cost of €5 and an annual fee of €10. Players simply request it at a post office, after which the card is at their disposal. We call it a card, but the features it offers make it seem more like a bank account; in fact, it has its own IBAN code. Players can perform almost any financial transaction with this card. If this is the only charged Postepay card you have, the maximum balance is €100,000. The daily withdrawal limit is €600, while the monthly limit is €2,500.

As for the second one, the issuance fee is €10, while the annual fee is €30 for the first year and €60 thereafter. However, the ceiling of this card is €200,000. The withdrawal limits are the same as those of the card described above. Postepay Evolution Business is active immediately upon receipt. If you choose this card, you have a full-fledged Mastercard at your disposal, which means you can make purchases in Italy, abroad, and on any Mastercard partner website.

Postepay offers additional cards as well; however, they are not as suitable for online gambling as the ones listed above. Visa-branded options are generally more widely accepted for both deposits and withdrawals, so you will not encounter any problems with the Standard Postepay Card.

Depositing in Online Casinos via Postepay

Making deposits in online casinos via Postepay is instantaneous and fairly simple. First, log into your gambling account and visit the Cashier section at your preferred casino. Choose Postepay from the list of available payment options, or, if you do not see it, select Visa or Mastercard depending on the type of prepaid Postepay card you own. Then, enter the amount you want to deposit into your casino balance.

You will be redirected to the Postepay website and required to provide your card information to process the transfer. This includes the Postepay card number, expiration date, and CVV/CVC security code. The Card Verification Value (CVV) code is printed immediately after the card number on the back of the card.

When you confirm the transaction, the new deposit should appear in your casino balance immediately. No fees will be charged for deposits through this method. In addition, some online gambling operators offer players reload bonuses when depositing via Postepay. At most casinos, the minimum deposit is €10.

Withdrawing Your Winnings via Postepay

Players can withdraw funds via Postepay by choosing it from the list of withdrawal methods on the casino’s Cashier page. Although most casinos do not specifically list Postepay as a payment option, it is still accepted if you select Visa or Mastercard and enter your card details.

The main thing to consider is the type of Postepay card you have and, more specifically, its limits. Check your card’s maximum capacity before requesting a withdrawal, especially if you are a high roller. For smaller sums you will most likely encounter no problems at all.

Keep in mind that casinos usually have a withdrawal-request processing time of about 24 hours. If your withdrawal is more than five days late, we suggest contacting customer support.

Fees

Online casino players benefit from the lack of processing fees with Postepay. Usually, casinos do not impose charges for deposits or withdrawals via this payment method, which is undeniably a great advantage for all Italy-based players. Choose your online casino wisely to take full advantage of this feature.

Online casino players benefit from the lack of processing fees with Postepay. Usually, casinos do not impose charges for deposits or withdrawals via this payment method, which is undeniably a great advantage for all Italy-based players. Choose your online casino wisely to take full advantage of this feature.

Overall, transactions with Postepay cards incur insignificant fees that range between €0.30 and €1. For specific transactions such as currency conversions, the fees may be higher. The type of Postepay card you possess also matters. Mostly, however, transactions between Postepay users are entirely free of charge and, as already noted, casinos usually do not charge Postepay players an additional fee.

Security

Along with its simplicity and availability, the Italian prepaid card service Postepay also provides gamblers with high levels of online protection. This is a very secure payment method because, when using it for gambling online, players do not disclose credit/debit card information, bank-account information, or any other personal data.

Even if your information somehow falls into the wrong hands, no one other than you would be able to use it. Postepay cards are secured like Visa and Mastercard products, with top-of-the-line security protocols in place. One of them is 3D Secure – an XML-based protocol designed as an additional security layer for credit and debit cards. It adds one more authentication step: the one-time password (OTP). This password is sent to your phone free of charge and is used to authenticate a single transaction.

Postepay cards adhere to the latest web security standards, so this OTP feature is entirely free. For Visa users it is known as Verified by Visa, and for Mastercard users it is called Mastercard SecureCode. However, no protocol is infallible, so remain cautious. Players are unlikely to encounter any security problems, as online casinos keep personal data highly encrypted, making unauthorized access virtually impossible.

Advantages

The greatest advantage of Postepay is that it functions like a prepaid debit card while offering much higher security. When using one of its cards, you enjoy the convenience of credit/debit cards combined with the instant transfers and security of e-wallets. There are no processing fees, while the cost of purchasing a plastic Postepay card is insignificant.

The greatest advantage of Postepay is that it functions like a prepaid debit card while offering much higher security. When using one of its cards, you enjoy the convenience of credit/debit cards combined with the instant transfers and security of e-wallets. There are no processing fees, while the cost of purchasing a plastic Postepay card is insignificant.

Through the Postepay mobile application, users can send and receive funds in real time from their phone contacts, as long as those contacts also have a Postepay account. The app gives you mobile access to your Postepay account, so you can transfer money on the go or customize your account and preferences. It can also be used for transfers to and from PayPal accounts.

In addition, Postepay users can always control their spending and monitor all transfers even on a mobile device. Despite the fact that most casino websites do not specifically mention Postepay, the payment method is still accepted, as the issued Postepay cards are under the Visa and Mastercard brands.

Another advantage for Postepay users is the My Cards feature. With it, you can customize your card’s functionality and capabilities. You can restrict certain features or disable them altogether while enabling others, tailoring your card to your specific gambling needs.

Yet another advantage of using a Postepay card is that you can renew it for free. All funds are transferred from your old card to your new one at no cost. You can renew your card online or via the toll-free number 800 00 33 22.

Disadvantages

Although Postepay can be used online and in stores around the world, it is available only to Italian residents. In fact, you need to be an Italian citizen – or at least work in Italy – to create a Postepay account, as the issuer requires an ID and a social-security number or, alternatively, a tax identification number.

If you lose your Postepay card, you will have to pay €5 for a replacement. That is not a lot of money, but in cases of theft it is certainly unpleasant. It is somewhat surprising that there is a charge in such cases, given that renewing your card is otherwise free and you can deactivate it at no cost.