Casinos Accepting Echeck

Searching for top online casinos that accept eCheck? Check our expert shortlist of the best casino sites allowing eCheck deposits and withdrawals.

While some online casinos offer their customers a wide range of payment options, others support only a limited number of methods. If you have no other payment solutions at your disposal, one alternative you can find across numerous online casinos is eChecks. Conveniently, this option can be used to make quick deposits into your online casino account, allowing you to manage your bankroll safely and easily. Often, eChecks are also supported for withdrawals, enabling players to receive their casino winnings securely. They are particularly popular among players who have limited alternatives. Moreover, eChecks are widely available, making them easily accessible to players around the globe.

| Summary | |

|---|---|

| Countries used in | Worldwide |

| Website | N/A |

| Accepted by | 51 Online Casinos |

| Casino games with eChecks | Slots, Table Games, Video Poker, Live Casino |

| Available for deposit | Yes |

| Available for withdrawal | Yes |

| Create account / Sign up for account | Opening a checking account is free. |

| Monthly fee for a checking account | Depends on the banking institution. |

| Make a payment via an eCheck | Usually free, but there may be fees ranging between $0.30 and $1.50. |

| Transfer funds from eCheck to bank account | Your checking account is linked to your bank account, so there is no need to transfer any funds. |

| Transfer funds from Merchant to an eCheck | Usually free, or there might be a very small fee. |

| Online Chat | N/A |

| N/A | |

| Telephone | N/A |

Pros and Cons of eCheck Casinos

- Pros

- Enables instant online casino deposits

- Players can open their checking accounts online

- Often available to players who have limited payment options

- Some casinos support eChecks for both deposits and withdrawals

- Cons

- Using an eCheck requires opening a checking account

- May not be available for withdrawals

- Withdrawals via eChecks may take up to 10 days

Top Rated eCheck Casinos

-

Trustpilot Score

4.3

Licenses • The UK Gambling Commission (38620)

• The Кahnawake Gaming Commission (KGC)

• Alcohol and Gaming Commission of Ontario (AGCO)Supported languages English, German, French Customer support channels Live chat, Email (support@crhelpdesk.com) Luxury Casino is one of the platforms operated by Casino Rewards, a reputable casino network with a long history in the online gambling industry. Its operations are monitored and regulated by the MGA, UKGC, and the Kahnawake Gaming Commission, which is more than enough proof of the legitimacy, fairness, and reliability of this online casino.

- Pros

- Demo mode available for risk-free play

- Wide slot selection including Cash ‘N Rewards Megaways

- Nearly 80 table game variants of blackjack, roulette and baccarat

- Website offered in English, German and French

- Broad range of payments like Interac, Skrill, Neteller and AstroPay

- Cons

- Availability of payment methods varies by region

- No dedicated mobile app in some regions

- Pros

-

Sun Palace Casino

Trustpilot Score

3.4

Licenses Government of Costa Rica

Supported languages English Customer support channels Live chat, Email (support@sunpalacecasino.eu) Usually, when a casino is said to be run by a company based in Costa Rica, players are suspicious of it. There have been numerous cases over the years that justify such behavior but rest assured that Sun Palace Casino is an exception to the rule and you won’t go wrong registering an account with it. The brand is fueled by Realtime Gaming, which provides betting software to gambling enthusiasts from all over the world with a notable focus on Canada and the US.

- Pros

- Powered by reputable developer Realtime Gaming

- High quality graphics across entire portfolio

- Strong selection of video poker titles such as Jacks or Better

- Accepts cryptocurrencies alongside cards and Interac

- Tailored to players from Canada and the United States

- Cons

- Game catalog is limited to about 200 titles

- Banking options are fewer than at global brands

- Pros

-

Trustpilot Score

4.3

Licenses UK Gambling Commission (38620)

Kahnawake Gaming Commission (KGC)

Alcohol and Gaming Commission of Ontario (AGCO)

Customer support channels Live chat, Email (support@crhelpdesk.com) Yukon Gold Casino is a highly regulated operator that has been in the online gambling industry for nearly 20 years and knows well the habits and preferences of players. Thanks to its extensive experience and knowledgeable staff, the brand has all the tools for ensuring a flawless gaming experience. Its portfolio consists of more than 550 games distributed in the Slots, Roulette, Blackjack, and Video Poker categories. The most eye-catching is the Progressive Jackpots section due to the possibility for a player to add a life-changing amount to his bankroll.

- Pros

- Library of more than 550 casino games

- Progressive jackpots with life-changing payouts

- Minimum deposit requirement of only $10

- Frequent bonuses for new and existing players

- Supports popular methods like Visa, Skrill, Neteller and eCheck

- Cons

- Verification process can be time-consuming

- Payment availability varies by location

- No dedicated mobile app

- Pros

-

Trustpilot Score

4.3

Licenses Not specified

Supported languages English Customer support channels Live chat, Email (support@slotocash.us) Ever since its inception in 2007, Sloto Cash has been a preferred online destination for many slot fans. The platform has an uncluttered and simple layout that allows users to easily navigate between the various sections of the website. The gaming lobby is divided into several distinct categories and provides direct access to the cashier menu. The deposit and withdrawal methods there are not as many as with global online casinos, but reliable options such as credit and debit cards, digital wallets, eChecks, and a few cryptocurrencies are still available.

- Pros

- Clean and intuitive site layout

- Accepts credit cards, eChecks, digital wallets and crypto

- Mobile-friendly website for instant play

- Regularly updated RealTime Gaming slot lineup

- 24/7 live chat customer support

- Cons

- Overall game count is around 200 titles

- No standalone mobile app

- Some payment methods not available in all jurisdictions

- Pros

-

Trustpilot Score

4.3

Licenses Kahnawake Gaming Commission (KGC)

UKGC (038620)

Alcohol and Gaming Commission of Ontario (AGCO)Supported languages English, German, French Customer support channels Live chat, Email (support@crhelpdesk.com) Grand Mondial Casino is an online gambling platform that caters to players of all tastes. Its general table game section, for example, includes both virtual titles and various live dealer variations of classic games like blackjack, baccarat, poker, and others. If you are an avid slot fan, you will be pleased to know that Grand Mondial has a large selection of them, too. Players can have a great time with hundreds of titles, all of which feature high-quality graphics and thrilling gameplay. Atlantean Treasures Mega Moolah, Immortal Romance Mega Moolah, and Mega Vault Millionaire are three of the most popular games provided.

- Pros

- Mix of live dealer and virtual table games

- Large collection of popular progressive slots

- Multiple banking options including eChecks and local solutions

- 24/7 customer support via live chat and email

- Responsive mobile site for play on smartphones and tablets

- Cons

- Full banking details shown only after registration

- No dedicated mobile app

- Pros

-

Trustpilot Score

2.4

Licenses Government of Curacao

Supported languages English Customer support channels Live chat, Email (support@cherrygoldcasino.com), Phone (+16469050496) Cherry Gold Casino is a legitimate online casino that offers over 200 slot titles as well as a variety of casino favorites such as blackjack, roulette, and poker in both virtual and live dealer variations. This is a platform for fans of less is more who appreciate the simple design that allows them to quickly find what they are looking for. Cherry Gold Casino is licensed by the Curacao Gaming Control Board and bears the SSL encryption seal for the protection of funds and sensitive information.

- Pros

- Over 200 slot titles plus live dealer classics

- Simple interface for quick navigation

- Licensed by the Curacao Gaming Control Board

- Regular promotions such as welcome and monthly bonuses

- Supports crypto deposits without upper limits

- Cons

- Minimum deposit set at $25

- Limited payment choices beyond cards and crypto

- Pros

-

Trustpilot Score

2.2

Licenses • The Malta Gaming Authority (MGA/CRP/217/2012)

• The Swedish Gambling Authority (SGA)

• The Alcohol and Gaming Commission of Ontario (AGCO)

• The Spanish Directorate General for the Regulation of Gambling (DGOJ)

• Irish Revenue Commissioners (revenue.ie)

• Government of Gibraltar (Remote Gaming Licences no 126 and 127)

• UK Gambling Commission (61549)Supported languages English, Swedish, Finnish Customer support channels Live chat, Email (hey@casumo.com) For over 10 years now, Casumo Casino has been delighting gambling enthusiasts from different parts of the world with its eye-catching design and huge gaming library. Casino enthusiasts have access to over 2,000 slots, which offer an impressive array of themes, features, and progressive jackpots. The available titles are provided by Play’n GO, Microgaming, NetEnt, and a number of other noteworthy software developers, ensuring that the operator can meet the needs of all types of gambling enthusiasts.

- Pros

- Vast library of 2,000+ slot games

- Content from leading providers like Play’n GO and NetEnt

- No fees on deposits or withdrawals

- Low minimum deposit of $10

- Dedicated mobile apps plus optimized web version

- Cons

- Some payment options depend on player location

- Verification checks may delay withdrawals

- Pros

How eChecks Work

To submit an eCheck, all you need is a valid checking account and to fill out the required forms.

To submit an eCheck, all you need is a valid checking account and to fill out the required forms.

The process is similar to that of standard checks, which people have been using for decades. However, before you can issue checks, you need to open a checking account with a bank that supports this option.

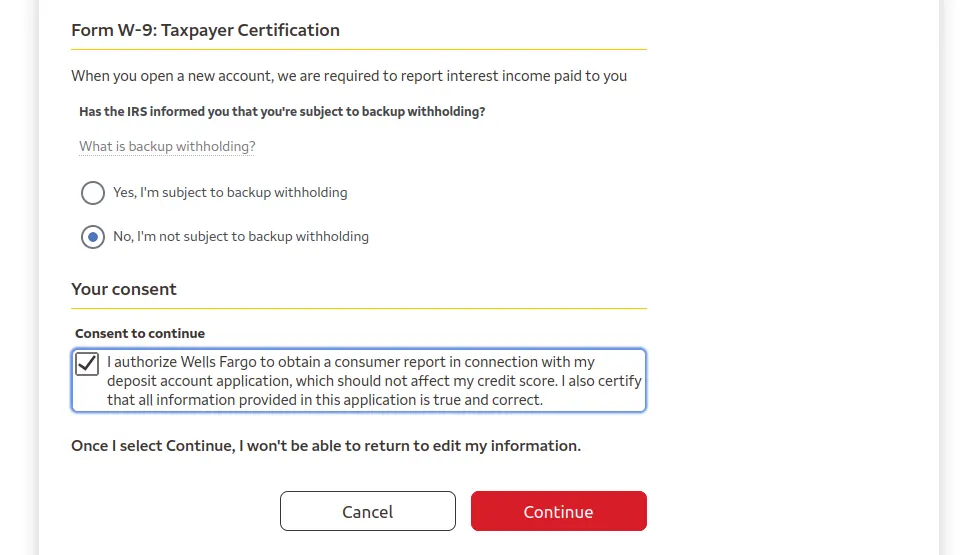

Before Using eChecks, Players Must Set Up a Checking Account

Most major banking institutions and payment gateways offer their customers the option to pay via eChecks, but they require a checking account. A checking account should not be confused with a standard bank or savings account because there are several important differences.

A checking account, sometimes referred to as a transactional or demand account, is distinguished by its enhanced liquidity; account holders have immediate and easy access to their available funds.

This access is typically provided through several avenues. Players who hold checking accounts can access their funds by issuing paper checks or eChecks, by setting up automatic transfers, or by withdrawing money directly from an ATM with their debit cards.

Another feature that distinguishes checking accounts from standard bank or savings accounts is that they allow an unlimited number of deposits, and there are usually no restrictions on the number of withdrawals you can make each month.

Casino players planning to use eChecks should first choose a checking account that best fits their needs, as banks offer various options. Most banks provide comparison charts of their checking account types on their websites.

A checking account usually has minimum balance requirements. Before opening one, also consider how many eChecks the bank allows you to process each month. If you are a regular casino player who deposits frequently, choose a bank that permits a higher number of monthly eChecks.

Another factor to consider is the monthly maintenance and overdraft charges you may incur. Many banks charge maintenance fees on checking accounts, and one way to avoid them is to meet the bank’s minimum daily balance requirement.

After you find a bank that offers your preferred checking account, you can either visit a branch in person or complete the application online. You will need to provide information such as your Social Security number, permanent address, phone number, and a valid email. Once your checking account is set up, you will be able to make instant online payments to and from your casino.

eCheck Registration Process

Issuing electronic checks is very similar to issuing traditional paper checks. To use eChecks for gambling-related transactions, you must first open a checking account with your financial institution. While checking accounts share many characteristics with standard bank accounts, there are some notable differences, the most obvious being that checking account holders can issue checks.

Competition in the banking sector is fierce, and financial institutions simplify their procedures to attract customers. This also applies to opening checking accounts online, which often takes no more than half an hour. Keep reading to learn the steps you need to take before using eChecks to deposit to or withdraw from your virtual casino balance.

- Thanks to technological advances in recent years, it is no longer necessary to visit a physical bank branch to open an account. Simply visit the institution’s official website and explore the checking options it offers.

- The bank’s Checking Accounts page will provide everything you need to know before opening an account, including details on the various plans, associated fees, and limits. The majority of users choose Everyday Checking.

- After carefully reading the terms and conditions and deciding they are acceptable, you can start the registration process. Because you are dealing with a regulated financial institution, be prepared to provide detailed personal information, including your name, ID number, date of birth, citizenship, postal and email addresses, occupation, and more.

- Electronic forms vary depending on the bank and the jurisdiction in which you reside. For example, you may be asked to provide information about your tax status.

Video Introduction of Echeck

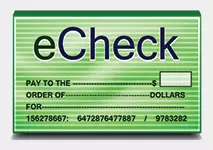

Depositing to Online Casinos

eChecks are an efficient, secure, and prompt way to boost your online casino balance. To make a deposit, go to the cashier page, select ‘Instant eCheck,’ enter your details, and confirm the payment. The information required is the same as for regular paper checks – your name, account number (also called DDA, usually between 8 and 10 digits), routing number (known as ABA, usually 9 digits), the bank’s name, and the date you want the money withdrawn from your checking account. The payment is processed instantly, and you can start playing right away.

eChecks are an efficient, secure, and prompt way to boost your online casino balance. To make a deposit, go to the cashier page, select ‘Instant eCheck,’ enter your details, and confirm the payment. The information required is the same as for regular paper checks – your name, account number (also called DDA, usually between 8 and 10 digits), routing number (known as ABA, usually 9 digits), the bank’s name, and the date you want the money withdrawn from your checking account. The payment is processed instantly, and you can start playing right away.

It is important to note that different payment gateways and banking institutions have different policies regarding eChecks. We recommend contacting the casino’s support team to ask whether they accept eChecks from your bank.

Once you fill in the form, review it to ensure that all information has been entered correctly. After you confirm the transaction, your casino balance is immediately credited with the specified amount, provided the funds are available in your checking account. You will receive a unique confirmation number, which you should save as proof of the transfer in case any issues arise.

Withdrawing from Online Casinos

One of the biggest advantages of depositing with eChecks is that, in most cases, they are also available for withdrawals. The withdrawal procedure is just as straightforward as initiating your deposit. However, some casinos do not support eCheck withdrawals. Contact the casino’s customer support to confirm your options. If you cannot withdraw money via eCheck, you will need to use another method, such as wire transfer, a physical check, or a third-party payment service.

Casino players who plan to withdraw via eCheck must consider several factors. If this is your first withdrawal, the casino will ask you to verify your identity.

If you deposited with a card but intend to withdraw via eCheck, the casino will still require you to undergo verification, including sending copies of your card’s front and back along with additional documents. This confirms both your identity and your payment method. Some casinos also require you to withdraw using the same method you used to deposit. Therefore, if you want to withdraw via eCheck, it is best to deposit via eCheck whenever possible.

Another factor to keep in mind is the processing timeframe. Unfortunately, eCheck withdrawals are not as prompt as deposits because each payment leaving a player’s account must be approved by the casino’s finance department to ensure the request comes from the rightful account owner.

Withdrawal approval times vary between 24 and 72 hours, depending on the casino. After approval, you should receive the funds within up to five days, although some casinos may extend this to 10 days. If you are unsure how long your withdrawal will take, contact customer support. Even so, eCheck withdrawals are still faster than standard paper checks, which can take several weeks.

Fees and Limits

This type of online transaction is considered one of the most convenient payment methods because of its simplicity, ease of use, and swift transfer of funds. Another advantage is the low cost. Many casinos process eCheck payments free of charge, but additional fees may apply depending on your bank’s policies. The average cost of an eCheck transaction ranges between $0.30 and $1.50.

Additionally, your bank may charge a monthly maintenance fee if your checking account balance drops below the required minimum. For example, Bank of America waives the maintenance fee as long as the customer’s balance does not fall below $12. If your balance is insufficient and your payment fails, you may incur another service fee. The exact amount varies by bank, but it typically ranges from 5% to 25% of the eCheck’s value.

Minimum deposit limits for eChecks are higher at most online casinos, especially when compared to other methods, which typically range from $5 to $20. In contrast, the minimum amount you can deposit via an eCheck is usually about $100. The upper limit is also higher but varies, so we recommend checking with the casino’s cashier or support staff for details.

Security

Using eChecks is a secure way to pay casinos that accept them. The payment is made directly from you to the casino, eliminating middlemen as with credit card transactions. Casinos also benefit from the system’s advanced security, which incorporates digital fingerprints and tracking.

Using eChecks is a secure way to pay casinos that accept them. The payment is made directly from you to the casino, eliminating middlemen as with credit card transactions. Casinos also benefit from the system’s advanced security, which incorporates digital fingerprints and tracking.

This high level of security is achieved through several techniques in addition to tracking, including digital signatures, public-key cryptography, transaction authentication, and duplicate detection. Because the entire process occurs online, tracking payments is also much simpler.

Each transfer is assigned a unique tracking code that players can use as a reference and transaction record. Although providing personal and banking information may be uncomfortable for some, the entire process is heavily encrypted, keeping your details safe. Casinos themselves have no direct access to this information, and you can send payments to multiple casinos from the same checking account.

This electronic money transfer method is far safer than its paper counterpart because no physical document needs to be mailed to the casino. Additionally, banks protect their customers against misappropriation and fraud.

For example, Federal Regulation E requires US banks to reimburse checking account holders and allow them to void transactions they believe are fraudulent, provided action is taken within 60 days of the unauthorized transfer appearing on their statement. Furthermore, US holders of checking accounts are protected by the policies of the Federal Deposit Insurance Corporation (FDIC), which insures checking and savings accounts for up to $250,000 in the event of bank insolvency.

Availability

The beauty of eChecks is that they are available worldwide and accepted by most large and reputable online casinos. Furthermore, eChecks serve as a fitting payment alternative for players from jurisdictions such as the United States, where online casino gambling is largely restricted.

The beauty of eChecks is that they are available worldwide and accepted by most large and reputable online casinos. Furthermore, eChecks serve as a fitting payment alternative for players from jurisdictions such as the United States, where online casino gambling is largely restricted.

These players may be able to deposit with a prepaid or debit card only to discover that withdrawals to the card are blocked by the issuer. Because US gamblers cannot use popular digital wallets such as Skrill or Neteller, they often have their withdrawals processed via bank transfer or eCheck – the faster of the two. The same applies to players who use offshore-licensed casinos but reside in jurisdictions where online gambling is prohibited without a local license. Online casinos in the United Kingdom, on the other hand, are fully legal and thriving. They offer many diverse payment methods, eChecks being one of them.

Advantages

We live in the age of the Internet and are always connected, even when away from a computer. Most banks that service checking accounts also have their own mobile applications for Android and iOS. This makes it easier for players to top up their casino accounts from anywhere.

We live in the age of the Internet and are always connected, even when away from a computer. Most banks that service checking accounts also have their own mobile applications for Android and iOS. This makes it easier for players to top up their casino accounts from anywhere.

The main appeal of eChecks over paper checks for both players and casino operators is the immediate transfer of funds, allowing players to start gaming almost as soon as the payment is sent. Meanwhile, if they send a paper check, they would have to wait several days, at which point they may lose the desire to play. In addition, the sum can be refunded by the bank within 60 days of issuing the check (similarly to a credit card) should any trouble or fraudulent activity occur.

Another advantage of using eChecks is their worldwide availability. Players from any country can choose them as a payment method, provided the casino they join supports eChecks as a banking option.

Accepting eChecks is especially beneficial to players from the United States, who often struggle to process payments to foreign online casinos due to legal restrictions that prevent payment service providers and financial institutions from handling such transactions. Of course, a bank may still decline a transaction, but the chances of this happening are much smaller.

The eChecks can also help reduce the risk of overspending and debt accumulation. Since the money for the transfer is deducted from the player’s checking account, which contains only liquid funds they use for day-to-day expenses during the month, it is impossible for a gambler to slip into debt.

Many online casinos accept eChecks for both deposits and withdrawals. Players who have checking accounts are provided with a card that they can use to withdraw their winnings from any ATM worldwide. Although eCheck transactions are not as popular as other payment methods, they sometimes come with bonuses: typically, a 10% deposit bonus or a fixed-amount bonus awaits players at most large casinos.

Disadvantages

A drawback of using eChecks is that, because funds are released from your account quickly, you must ensure you have the full amount in your checking account at the time of transfer; otherwise, the check may bounce. You should also note that the bank will most likely not issue a copy of a canceled check, even if presented with a paper one. If the check bounces due to insufficient funds, the player is almost guaranteed to be charged a hefty fee.

The higher minimum deposit limits may also be deemed a disadvantage, especially if one is a small-scale player who prefers to deposit around $50. Last but not least, eChecks are not as time-efficient as other widely used payment methods like cards and e-wallets, at least where withdrawals are concerned.